Nationwide Experts - Payment Bond Mesa AZ

Call 800–562-8962

Apply Online Download Applications Agent

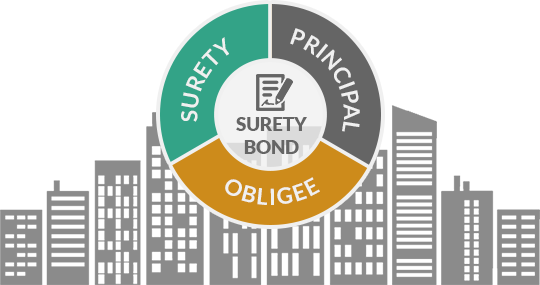

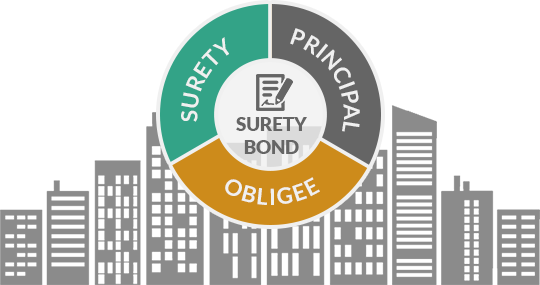

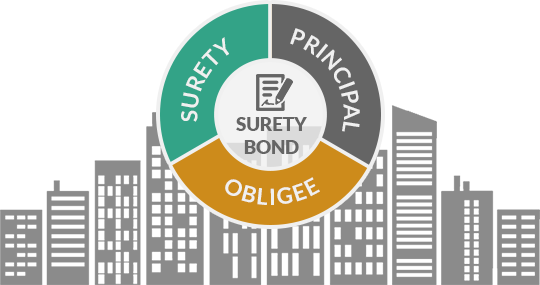

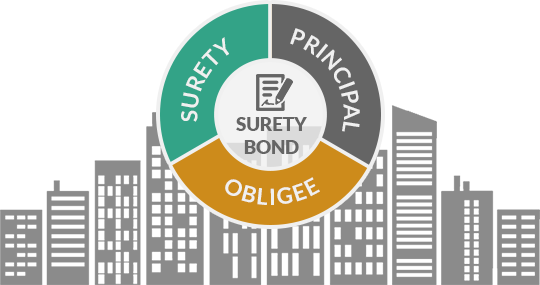

Payment bonds is a type of surety bond that is given to contractors as assurance that they will pay their laborers, material suppliers, and subcontractors on time. It is typically acquired by contractors or subcontractors prior to the start of a building project. It is an agreement between the principal (the contractor) who obtains the bond, the obligee (the subcontractor, supplier, or worker), and the surety bond company that assumes responsibility for the bond. Their job is to ensure that the labor and supplies delivered by subcontractors and suppliers are paid on time and in accordance with the contract. It ensures that payments for labor and materials are in accordance with state and federal laws and regulations. It protects subcontractors by providing legal recourse against contractors who fail to meet their contractual obligations. If a contractor fails to pay subcontractors, suppliers, and laborers, they can file a claim against the payment bond and receive compensation from the surety within a certain time frame. The cost of a payment bond is determined by the terms of the contract for which you wish to obtain a bond. It is a percentage of the contract amount that you were awarded during a bid. The surety will consider your financial situation when determining your payment bond rate. Sureties rely heavily on your personal credit score as an indicator and predictor of financial stability. You will be offered a payment bond at 1%-3% of the total bond amount if you have a high credit score.

Our payment bonds service is intended to assist people in acquiring payment bonds. We provide candidates with a high-quality, streamlined service even if they have a bad credit history or have previously encountered financial troubles. In addition to delivering superior and creative payment bond solutions, our experts make the procedure quick and easy. We provide the most cost-effective protection in the business, backed by a staff of experts in payment bonds. We are offering payment bonds at a rate cheaper than the rest of the market, with options for monthly, annual, or multi-year payments, so you may purchase them straight from us without needing any brokers or agents. Following the submission of your application, our specialist will work with you to find the best possible rate. No matter what size bond you require, Once we have your application, we can help you obtain your Payment Bond within a few business days. We can also assist you in completing the application process as quickly as possible. Call us or use the form on our website to get in touch with one of our surety bond experts. You can ask for a free estimate at any time with no obligation.

Hi my name is Kathy White and I can get you the best pricing on the payment bond you need for your business. We specialize in challenged credit and can get most anyone bonded and insured… Just fill out and submit the information and we will get back with you soon.

Apply Online

Hi my name is Kathy White and I can get you the best pricing on the payment bond you need for your business. We specialize in challenged credit and can get most anyone bonded and insured… Just fill out and submit the information and we will get back with you soon.

Apply Online Payment bonds are the area of expertise for USA American Eagle Bonds Insurance Agency LLC's clients. We are the largest supplier of payment bonds in the USA. Compared to our closest rival, we really write twice as many bonds. Having worked in the security bond sector for over 20 years with some of the biggest businesses, we are skilled in getting the best bond for you. We provide you with a business that is unmatched by anyone else. For many years, we have provided each and every one of our clients with excellent service. Our long-standing connections allow us to guarantee that you get the best contract and commercial surety the market has to offer. We streamline and accelerate the process. We have put together a team of experts to fulfill your needs and respond to your inquiries since we are fast growing. You can read some of our client reviews to learn why people prefer us over other bonding companies. To get your Payment bonds needs met, give us a call or request a quote online today.