Frequently Asked Questions about

Surety Bonding

WHAT IS A SURETY BOND?

Surety Bonds are not insurance.

Surety Bonds are merely an extension of credit provided by a surety company in order for an individual or business to conduct their affairs. The premiums charged only cover the costs of providing this extension of credit. Premiums do not cover the damages or the cost of default to the obligee.

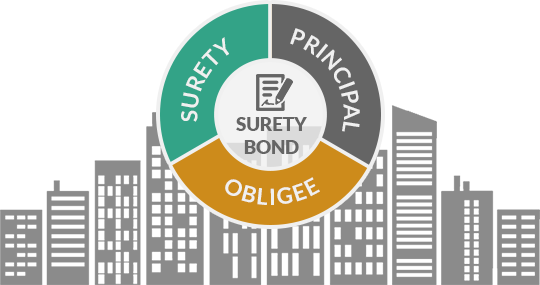

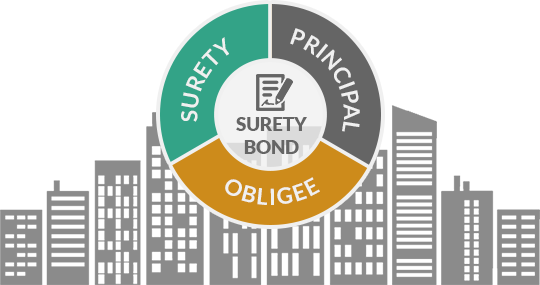

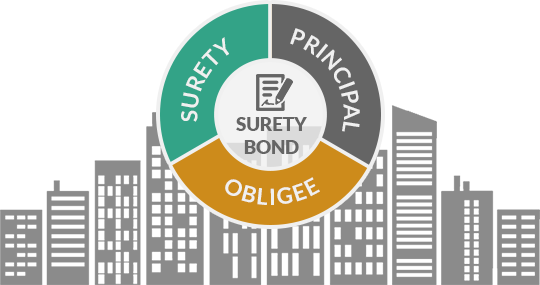

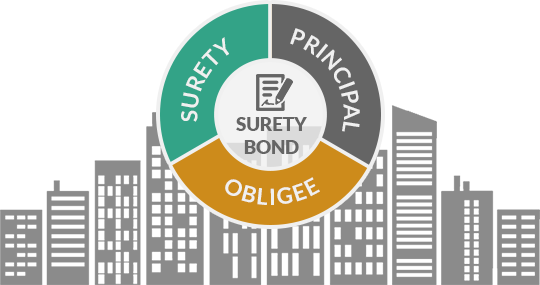

A Surety Bond is a written agreement or obligation, providing for monetary compensation (the Claim) to be paid by the surety company should there be a failure by the person bonded (the Default) to pay a claim or perform as required by an underlying contract, permit, ordinance, law, rule, regulation or state statute.

WHY DO I NEED A SURETY BOND?

The obligation to pay the debts of, or answer for, the default or non-performance of another is a legal relationship based upon a written contract (the Bond) in which one person or corporation (the Surety) undertakes to answer to another (the Obligee) for the debt, default or non-performance of the Principal only if and when the Principal fails to pay a claim or perform as required.

WHAT IS INDEMNITY?

An Indemnity Agreement between the Principal and the Surety Company is required by the Surety Company for each and every bond issued. The Indemnity Agreement holds the Surety Company harmless from any loss and expense the Surety Company may incur should a claim arise against a bond due to a default of the Principal. The Indemnity Agreement pledges all personal and corporate assets owned by the Principal and the Principal’s spouse. This allows the Surety Company the means to recapture any claim paid by the Surety Company if a loss occurs.

IS COLLATERAL REQUIRED TO OBTAIN A BOND?

Should the personal and corporate assets not be acceptable to the Surety, and/or if the personal and corporate credit history are questionable, then collateral or an additional indemnitor or both may be required by the Surety Company to guarantee reimbursement to the Surety Company if a loss occurs. A Surety Company may also require collateral if there is a high risk or unusual obligation on the bond because it will reduce some of the risk that a Surety Company assumes when issuing a bond. Some acceptable examples of collateral are cashier’s checks, certificates of deposit and irrevocable letters of credit. After all obligations of the bond have been met, the collateral is returned to the Principal and the Obligee releases the Surety Company from their obligation under the bond.

WHAT HAPPENS IF A CLAIM IS FILED AGAINST MY BOND?

In the event that a claim is presented to the Surety Company, the Principal will be officially contacted to pay the claim. If there is no response from the Principal to settle the claim and the claim is paid by the Surety Company, then the following collection procedures may be implemented:

Court action against the Principal – Litigation.

Judgments filed against the corporate and personal assets.

All credit reporting agencies shall be notified of a personal and corporate collection account due to an unpaid bond claim.

Seizure of personal and corporate assets.

In most all cases, should any of the above collection procedures be implemented as the result of the Principal’s failure to pay on a claim, then the Principal’s ability to secure a bond from another surety company may be restricted.

HOW CAN I GET A SURETY BOND?

Contact American Eagle Bonding at

(855) 852-2663 and we will send you the application and forms that you need, or you can click here to download an application.

HOW LONG WILL IT TAKE TO GET A BOND?

Depending on the type of bond you need, most bonds can be issued in a day or two. Others may require additional information and the amount of time it takes to get the information to us is up to you. To process your request more quickly, be sure that all questions on the application are answered and be prepared to submit your personal and corporate financial statements.

Hi my name is Kathy White and I can get you the best pricing on the Bond you need for your business. We specialize in challenged credit and can get most anyone bonded and insured… Just fill out and submit the information and we will get back with you soon.

Apply Online

Hi my name is Kathy White and I can get you the best pricing on the Bond you need for your business. We specialize in challenged credit and can get most anyone bonded and insured… Just fill out and submit the information and we will get back with you soon.

Apply Online